Posts by Paulo Frencillo

BAD CREDIT MORTGAGE RATES STARTING AT 3.24%

With today’s low mortgage rate environment, most ‘prime’ clients are taking advantage of rates around low 2.0%. These rates are available for people who have good credit, these are usually for people that have credit scores above 680. What if you have had credit issues in the past and still rebuilding your credit? If you…

Read MoreWhat Mortgage Rate Applies to Me?

WHY ARE THERE DIFFERENT MORTGAGE RATES? We are not referring to the fixed-rate vs variable-rate mortgages. As that difference is obvious, one locks you into a long-term fixed rate the other varies depending on the prime lending rate. “I SAW A LOWER RATE ONLINE!” Everyone wants the lowest mortgage rate available. But it might be…

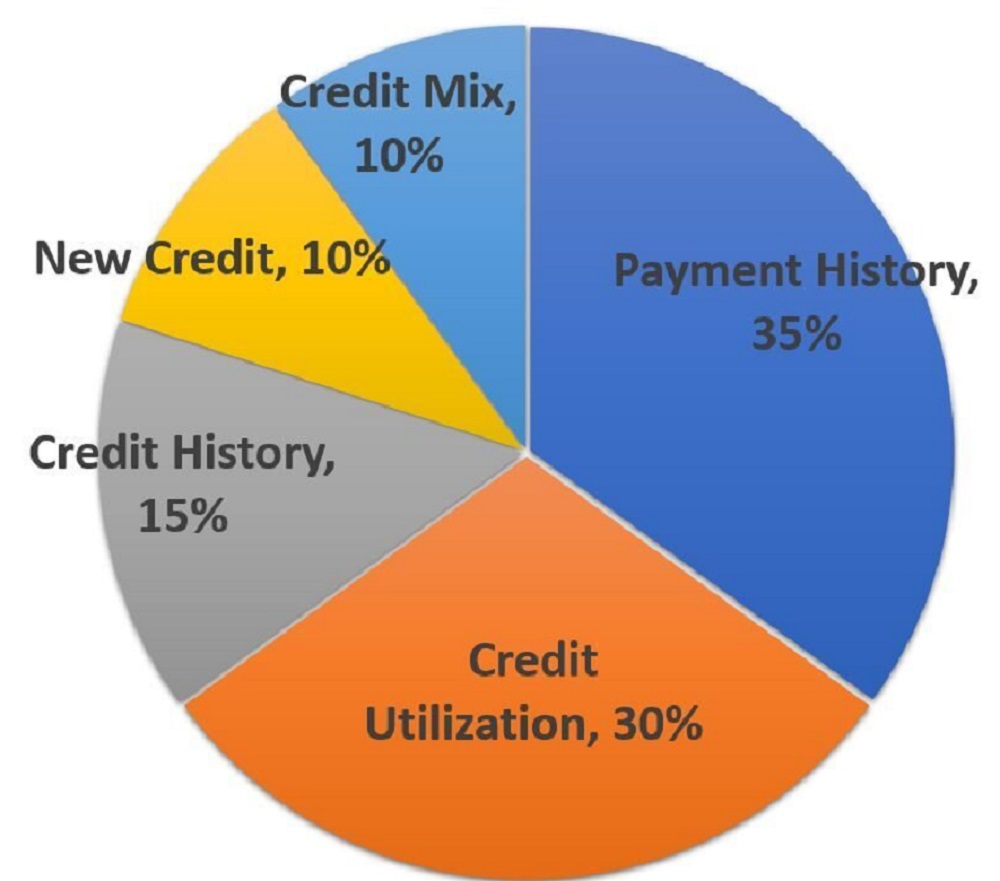

Read More5 Variables that Impact your Credit Score

In Canada, creditors such as banks, credit card, and loan companies report to two major credit agencies, Equifax and TransUnion. From this combined report you are given a credit score from 300 – 900, and this score represents your creditworthiness when you apply for credit. Ideally, you want a score above 680 to qualify for…

Read MoreFinancial Tips in Uncertain Times

As we are all facing this global crisis due to COVID-19, it is very important to protect our families from the uncertainties that the future holds. We will get past this pandemic, but we do not know how long the impact of this will have on our country’s economy. Many businesses are cutting costs by…

Read More