'Bank-Alternative' Mortgage Solutions

Ontario Mortgage Broker

About Mortgage Wars

"Bank-Alternative (B) Mortgage Solutions

for Real People in Ontario."

Mortgage Wars specializes in the space between traditional bank/ Prime (“A”) Lending and Private Mortgages—the Alternative / “B” lending (near-prime) market. We solve the problems that often lead banks to say “NO", and we do it with clear terms, transparent costs, and a plan to get you back to prime.

If you have 20%+ down payment or home equity, many more options open up. Our first stop is almost always Alternative (B) Lenders—we only look at private solutions when we have exhausted all other options.

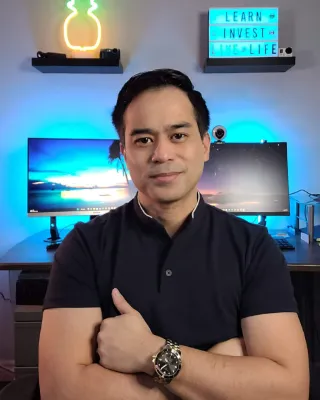

Meet Paulo

Paulo is the lead mortgage broker at Mortgage Wars with 20+ years experience in banking and mortgages. He’s worked as a Financial Advisor at three of Canada’s major banks, a senior mortgage underwriter, and a mortgage broker for 8+ years. Seeing the industry from every angle means you get practical, holistic advice—not just a rate, but a strategy.

GO beyond the BANK.

We’ll help you explore options

NOT offered by your bank!

Check out our Specialty Products!

Trusted Guidance, Proven Success

Paulo Frencillo | Mortgage Broker

(416) 907-2090

Office Hours

Mon to Fri: 9:00 am – 7:00 pm

Sat: 10:00am - 4:00 pm

Sun: CLOSED

Contact Us

(416) 907-2090

Office Hours

Mon to Fri: 9:00 am – 7:00 pm

Sat: 10:00am - 4:00 pm

Sun: CLOSED

Contact us

© 2026 Mortgage Wars - All Rights Reserved.

Paulo Frencillo, Mortgage Broker M12001122

BRX Mortgage 13463